While nuclear power companies around the globe have spent billions building small modular reactors over the last decade, the hype is giving way to hard financial realities—and investors are taking notice.

For one, NuScale Power would’ve brought the US its first commercial SMR via its highly-anticipated Carbon Free Power Project in collaboration with the Utah Associated Municipal Power Systems (UAMPS), but the project folded last November due to a lack of subscription. Last January, NuScale raised the target price for power from the SMR from $58/MWh to $89/MWh due to the “changing financial landscape for the development of energy projects nationwide.”

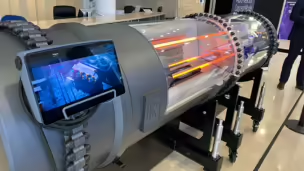

Several SMR designs remain in the running, including Westinghouse’s and GE Hitachi Nuclear Energy’s scaled-down versions of their larger reactors. These may go online at plants in Europe and Canada and within the next decade. More than 80 commercial SMR designs are being developed around the globe for electricity, heating, water desalination, and steam for industrial applications—and yet, the only SMRs to reach operation are located in China and Russia, and these aren’t online very frequently.

High costs and construction delays have some investors questioning the near-term financial viability of SMRs. “The UAMPS project was the nearest to a commercial order for an SMR there was,” Steve Thomas, an emeritus professor of energy policy at the University of Greenwich in London, told Ignition. “And while the industry would like to suggest orders are about to flood in, the reality is they are still some way off.”

You live, you learn: The halted UAMPS project offers a learning opportunity for future SMRs, Stephen Comello, co-managing director of the Energy Futures Finance Forum at the EFI Foundation, told Ignition. It’s very challenging to transport SMR modules, and it’s likely best to build a plant with access to water to enable delivery by boat, he said.

“You really need to find the right technology to fit the needs of the customer,” Comello said. “I think this may not have been the right technology for the geography.”

SMR risks: Even in the right location, SMR construction can still prove particularly pricy—despite claims that the module factory building process can prove cheaper than traditional reactor designs thanks to speedier, repeatable construction.

“Construction lines sound good but they are expensive to set up and need to be fully loaded if there are to be savings,” Thomas said. “That means it is a huge gamble, and if the reactor is not economic, someone is going to be left with a lot of components and half-built reactors.”

Seeking subscribers: As the shuttered NuScale project suggests, relying on utilities alone likely won’t help get SMR plants up and running.

“Traditional utilities have little interest in nuclear, especially where they are exposed to competition, because they cannot do what they have done in the past—invest in nuclear confident they can pass on all their costs to consumers,” Thomas said.

But according to Comello, these next-generation nuclear projects could receive support from consortia of buyers that may include utilities, data center operators, steel mills, and industrial companies, who could link up to pool demand and share costs and risks. Microsoft, Google, and steel production company Nucor recently partnered on this type of initiative.

“It could be anyone who needs the electricity,” Comello said. “The US is facing a tremendous load growth due to overall electrification, the reshoring of manufacturing—especially battery manufacturing—and the proliferation of data centers.”