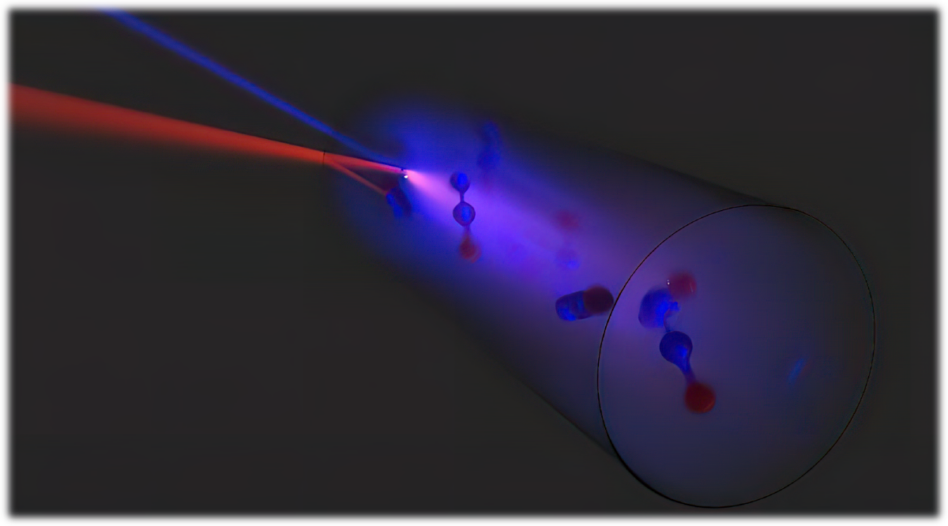

Uranium enrichment via laser sounds like something a Bond villain might cook up, but some view it as the key to boosting America’s competitiveness, attaining energy security, and achieving the Biden administration’s climate change goals all at once.

The idea of laser enrichment sprouted in the ’70s, touted as more energy-efficient and cost-effective than gas diffusion and centrifuges. However, enthusiasm and investment waned in the face of technical challenges, high costs, and doubts about market viability.

Now, laser is hoping to make its big comeback.

Beaming with confidence: LIS Technologies (LIST) raised $1.3M in seed funding this week to support the development and deployment of its proprietary laser enrichment system, CRISLA.

- CEO Christo Liebenberg said the round will fund the startup’s four-phase master plan “to rejuvenate laser enrichment capabilities in the US.”

- A March 22 SEC filing states the company has a total of 43 investors.

Blast from the past: Liebenberg has 30 years of laser work under his belt, including a six-year stint at Silex Systems, an Australian firm that spearheaded laser enrichment commercialization in the ’90s.

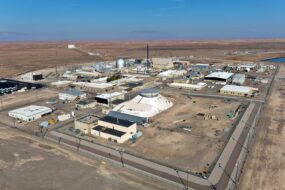

- Silex owns 51% of Global Laser Enrichment (GLE), a joint venture with Cameco that holds the license for the famed SILEX laser enrichment tech.

- In 2012, GLE was licensed by the NRC to build a laser enrichment plant in Wilmington, NC, but the project was shelved in 2021.

Moving on up: Both LIST and Silex have been pursuing laser enrichment, in part, to produce HALEU, i.e., uranium enriched between 5% and 20%—an upgrade from the 3-5% US reactors run on today. Higher enrichment is expected to be crucial for powering SMR projects.

- The DOE projects over 40 metric tons of HALEU will be needed by 2030.

- The fuel is not yet commercially available from US suppliers, and Russia has the world’s only commercial supplier.

HALEU, goodbye: However, Silex announced this week that it won’t respond to a DOE RFP to supply HALEU, instead prioritizing a UF6 production site in Kentucky.

- UF6 is used in the uranium enrichment process.

- Up to $500M in contracts will be awarded through this RFP and a separate one released in November.

LIST told Ignition it also won’t pursue the HALEU supplier RFP but will consider future DOE opportunities, including a $100M RFP expected later this year.