Oklo, a fast fission startup, has completed its SPAC merger with AltC Acquisition Corp.. Tomorrow, the combined company—now known as Oklo Inc.—will begin trading on the NYSE under the ticker “OKLO.”

- The merger has been highly anticipated since last summer. On May 7, AltC’s stockholders approved it almost unanimously.

- Investors find promise in Oklo’s positioning at the crossroads of two major trends: the rise of energy-hungry AI and the shift to clean energy.

- Enthusiasm for the merger centered on the involvement of OpenAI CEO Sam Altman, who is both chairman of Oklo and CEO of AltC.

Oklo joins other advanced SMR companies on the public market, including NuScale and BWX Technologies.

Not all sunshine: The road ahead for a nuclear SPAC—or special purpose acquisition company, for the uninitiated—is still uncertain.

- More than 20% of the nearly 500 SPAC deals that have closed since 2019 are trading below $1, according to Bloomberg.

- Last October, advanced nuclear reactor company X-energy and Ares Acquisition called off a $2B SPAC deal to go public, citing “peer-company trading performance,” among other reasons.

- In November, NuScale and a coalition of electric utilities in Utah scrapped plans for the country’s first commercial SMR due to cost overruns, delays, and a lack of subscribers.

Staying positive: Altman has called Oklo “the best positioned player to pursue commercialization of advanced fission energy solutions.”

- AltC’s stock has increased 40%+ this year prior to the transaction closing.

- Oklo secured over $306M of gross proceeds from AltC in the deal.

- Separately, Oklo recently received a $25M prepayment from a data center customer.

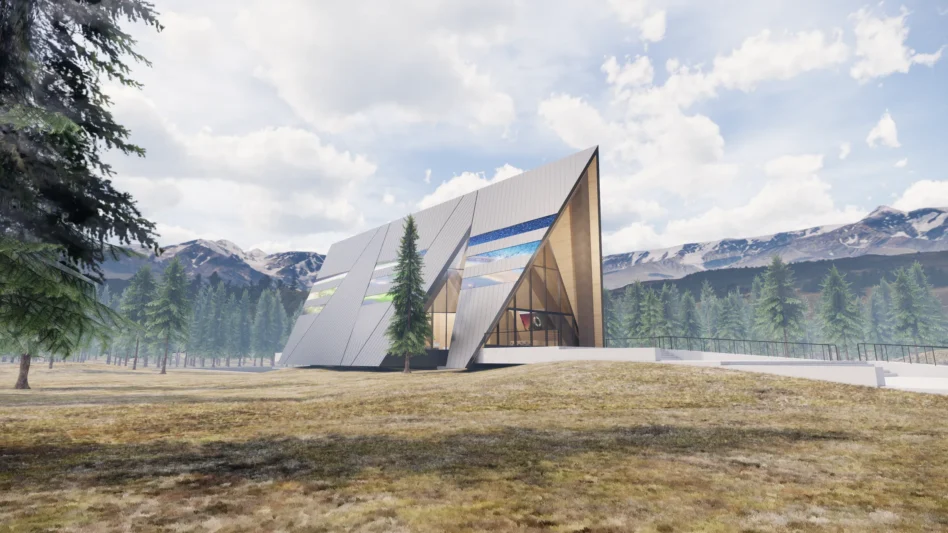

Oklo’s flagship product, Aurora, is a next-gen reactor designed to produce 15 MW of power and operate for a decade before refueling.