Xcimer Energy has topped the year-to-date record for a fusion company fundraise with its $100M Series A.

The round was led by Hedosophia, a UK venture capital firm known more for investing in software than deep tech. Xcimer also secured investments from Breakthrough Energy Ventures, Lowercarbon Capital, Prelude Ventures, Emerson Collective, Gigascale Capital, and Starlight Ventures.

Xcimer’s approach: The Denver-based fusion startup got its start in 2022, spurred by a leap in gain (i.e., power output) from fusion at the National Ignition Facility (NIF)—but before the announcement of net gain that made headlines in August 2023. That facility uses an approach called inertial confinement fusion, where a powerful laser zaps fuel pellets rapidly to get a reaction going.

“It was inertial fusion that worked,” Xcimer CEO and cofounder Conner Galloway told Ignition. “It had achieved net gain, and that’s what drew me to it as the lowest risk, most robust path to put electrons on the grid.”

- CTO and cofounder Alexander Valys had another way of putting it: “I said, ‘Geez, why are people investing so much effort in magnetic fusion, and these other variants of it, when inertial fusion has already been demonstrated to work?’”

Xcimer has plotted its development in three major phases:

- Phase One: A prototype laser system in the Denver facility within the next two years

- Phase Two: A full-scale engineering breakeven demonstration facility at some point after the first phase

- Phase Three: A fusion pilot plant within ten years

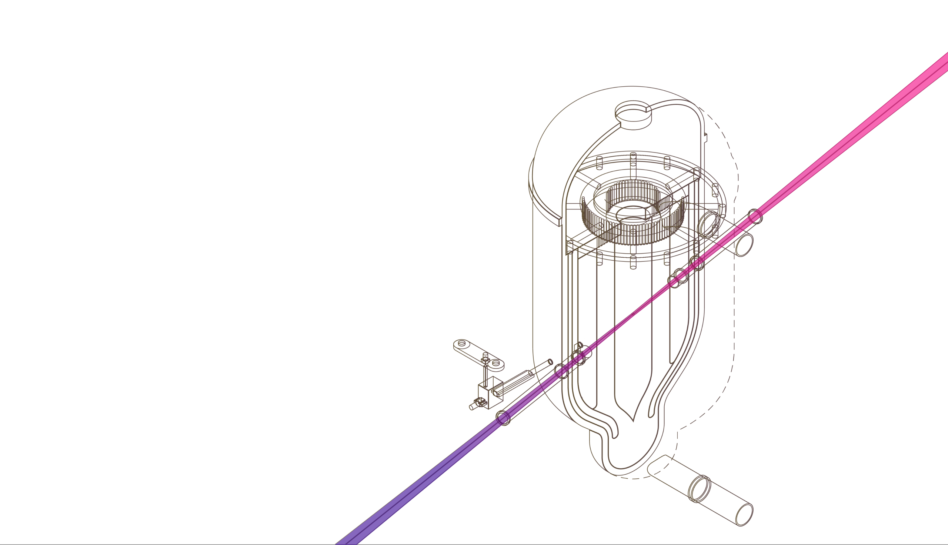

Frickin’ laser beams: As Xcimer sets out in earnest on its first major development phase, the key enabling technology is, essentially, a giant laser.

- True to its name, the company is building an excimer gas laser system based on past versions built in the ’80s under the DoD’s Star Wars program.

- Similar (but less powerful) lasers were once developed at scale for semiconductor manufacturing, and now it’s about making one powerful enough for commercial fusion.

“There’s no particular technical breakthrough or advance in manufacturing or materials…we’re depending on now,” Valys said. “The real thing that’s transformative is just between compute power and between investors’ attitudes [and] willingness to invest in ambitious deep technology projects.”

Xcimer is looking to increase efficiency and cut costs in a major way. The cost-cutting comes from using a gas laser rather than the glass laser used at NIF, which the company says will be 30x less expensive per joule than NIF’s approach. Xcimer expects to use orders of magnitude less glass material in its system.

“It’s kind of a motto,” Galloway said. “Don’t break glass, have a gas!”

Gaining steam: Fusion development is a costly endeavor, and if raising a minimum of $100M puts you in an elite club, then Xcimer is in good company—Commonwealth Fusion Systems, Helion Energy, SHINE Technologies, and General Fusion are there, too. Of these, Xcimer is the only company pursuing inertial confinement fusion.

Xcimer’s $100M raise is expected to carry the company through two major initiatives, per Valys:

- Building the Phase One prototype laser system.

- Concurrently working out supporting systems with partners, including “field capsule design, field capsule fabrication, the chamber, the energy capture, and thermal transport and energy conversion into electricity.”

Valys told Ignition that there are plans to generate revenue at some point before a commercial plant sells energy to the grid, but the company is keeping us in suspense re: those details.

As for headcount, Xcimer currently employs ~50 people full time, and with this fundraise aims to grow to 70 by the end of the year, with the vast majority of that growth on the engineering side. The company expects to add a few support hires and grow the executive team, too.

Lead Reporter of Ignition