It’s official: The US is cutting off the flow of Russian uranium to its fleet of reactors.

Last week, the president signed a bill to ban new imports of uranium from Russia. The law will come into force 90 days after enactment.

The story doesn’t end there (and what a boring newsletter this would be if it did!). Russia accounts for a significant chunk of the uranium used in the US, supplying 12% of US uranium ore and accounting for 24% of enriched uranium imports. To keep things running smoothly, American nuclear operators need A) some leeway in the transition from Russian fuel and B) a more robust domestic supply chain.

Can’t stop, won’t stop: Although reducing reliance on Russia for fuel and using good old American homegrown uranium to power the US nuclear fleet sounds good on paper, the fact remains that Russia is too important a supplier to cut off 100% of imports right away. There’s an existing nuclear fleet that needs to stay up and running.

- Those reactors have enough of a supply on hand to keep up operations for a while, but access to fuel is a concern in the long term.

The new law accounts for that outstanding fuel need by allowing operators to apply for waivers to import a certain amount of uranium per year. The cap decreases each year until 2028, when a complete ban sets in. The DOE said it will publish waiver details in the Federal Register within 30 days of enactment.

The Russian suppliers are just as anxious for details. Last week, Russian uranium supplier Tenex notified US customers that they have 60 days to secure a waiver exempting them from the recently passed uranium import ban or risk losing access to fuel, per Bloomberg.

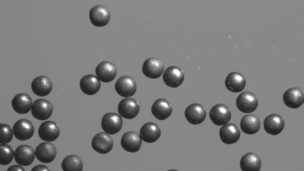

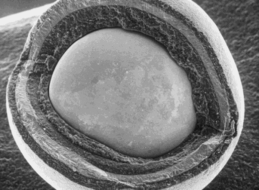

Bring it home: In the DOE’s 2024 budget, appropriators set aside $2.7B for domestic high-assay low-enriched uranium (HALEU) with the catch that the funds wouldn’t be freed up for use until a law was passed banning the import of Russian uranium. Lo and behold, the bill passed, and now the DOE is free to distribute those funds to specific US HALEU production projects.

A plan to use those funds is now underway. On Tuesday, the DOE published a pre-solicitation notice that it will ask industry for LEU production proposals, with the intention to award contracts up to $3.4B, including the recently freed-up $2.7B.

- The DOE will only consider US uranium enrichment and storage projects for the award.

- Allied nations are eligible to apply for mining and conversion contracts.

Ride the wave: The good news is that the push to reopen shuttered uranium mines and add domestic production is well underway. The Rosita mine in Texas reopened earlier this year, leading to the highest Q1 uranium production in the US since 2018, and more reopenings are planned elsewhere. The price of uranium—which nearly doubled over the last year—is driving commercial interest in kick-starting American production.

Lead Reporter of Ignition