It’s been a big week for new uranium production prospects around the globe, with three big announcements coming from the US, Kazakhstan, and Kyrgyzstan. We’ve got you covered with the roundup.

To set the scene…Uranium prices have fallen slightly since their highs in January of this year, but a pound of uranium is still going for $90.38 as of the end of May, up 66% YoY, per Cameco data. And with a US ban on Russian uranium officially signed into law and $2.7B freed up to support domestic uranium production initiatives, interest in restarting shuttered uranium production operations is on the rise.

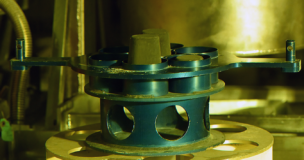

Alta Mesa gets cooking: A uranium processing facility in South Texas that last produced yellowcake in 2013 has gotten a new lease on life. The Alta Mesa processing plant is owned in a 70/30 split between enCore Energy and Boss Energy, respectively.

- enCore also reopened the Rosita processing plant in Texas earlier this year.

- Those two facilities make enCore the only operator of multiple plants in the US.

Production has begun at the Alta Mesa facility, which is expected to produce up to 1.5M lbs of yellowcake production per year by 2026, but it’ll take time to ramp up. The first yellowcake shipment is expected in Q3.

Kazakhstan plots an opening: The world’s largest uranium producer, Kazakhstan’s Kazatomprom, has secured key regulatory approval to open an extraction operation at the Inkai uranium deposit. The agreement is for up to four years of subsoil use, during which the company can extract up to 701 tonnes of raw, elemental uranium.

The new extraction rights at the key deposit are good news for Kazatomprom, which said earlier this year it expects to miss its production forecasts between now and 2030.

Kyrgyzstan hops on board: In 2019, Kyrgyzstan’s government banned uranium mining due to safety and environmental concerns, but the economic incentives of uranium production, especially with the rising spot price, are too powerful to ignore. On Thursday, lawmakers overturned that ban, but this time with an assurance to detractors that environmental considerations will play into the path forward.

- Kyrgyzstan’s history with uranium mining is closely linked to Soviet nuclear programs, and Agence France Presse reports that there are 92 sites across the country containing radioactive waste.

Lead Reporter of Ignition