…But it’s not all over yet.

Ultra Safe Nuclear Corp. (USNC), a leading microreactor developer working with a handful of US and foreign government agencies on reactor and fuel development projects, filed for Chapter 11 bankruptcy this week.

- The company has $50M–$100M in estimated liabilities, according to court filings, along with $10M–50M in assets.

- The announcement follows the death of USNC’s board chairman and most significant investor, Richard Hollis Helms, who had backed the company to the tune of $100M plus an additional $25M in loans. Helms died in May, and USNC has been on the hunt for new capital sources.

The bankruptcy announcement isn’t the last we’ll hear from the company. USNC’s filing revealed extensive restructuring plans, including selling off parts of the business in order to continue working on microreactor development under a court-supervised process.

“Ultra Safe Nuclear remains steadfast in its dedication to bringing safe, commercially competitive, clean and reliable nuclear energy to global power and industrial markets,” current board chairman Kirk Edwards said in a release. “After carefully exploring all available options, we have decided that this court-supervised sale process offers the best path forward while ensuring continuity across our key technology initiatives.”

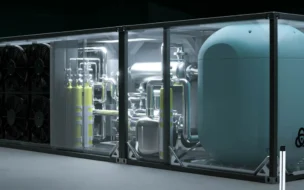

Ultra safety first: The company formed in 2011 to bring its fuel design to market. The company wanted to use pellets of TRISO fuel—a fuel design consisting of uranium, carbon, and oxygen—encapsulated in prismatic graphite blocks to ensure efficiency while maintaining a very high level of safety (hence the name).

- The company is developing a 45 MW thermal, 15 MW electrical microreactor that uses its TRISO fuel.

Since its founding, USNC has forged tons of partnerships to provide governments with nuclear power R&D and services. The company has contracts with the US DOE, NASA, and DoD and is also working on projects with the UK Department of Energy Security, Canadian Nuclear Laboratories, and Ontario Power Generation.

Who’s buying? According to a statement USNC issued to POWER Magazine, “Amongst the various…entities considering acquisition of the company’s assets, significant interest exists for all ongoing projects.”

To that point, in its bankruptcy filing, USNC identified Standard Nuclear as a stalking horse bidder for the company’s fuel-related assets, starting the bidding at $28M. This establishes a reliable minimum value for those assets to stoke market interest and reassure stakeholders. USNC requested court permission to complete that transaction in December.

Lead Reporter of Ignition