The need for uranium produced by friendly faces has become more urgent this year with the bilateral ban on Russian uranium heading to the US. The push for new nuclear stateside shows no signs of slowing, so there’s a looming need for increased uranium supply to fuel the fleet.

NexGen Energy, a Canadian uranium producer, aims to meet that need in the US market. The company last week announced contracts with US operators to supply 5M lbs of uranium from 2029 to 2033.

“Energy demand from reliable sources is increasing by the week with the need to expand existing nuclear energy infrastructure and the construction of power consuming data centres at a time the security of uranium supply is under significant technical and sovereign risk,” NexGen CEO Leigh Curyer said in a release.

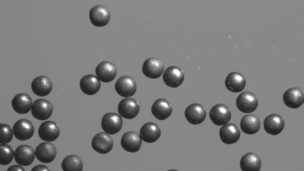

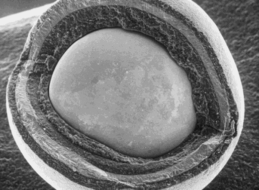

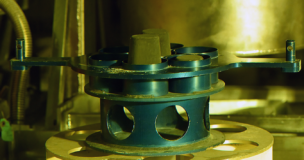

NexGen’s position: The Canadian uranium producer is betting big on the need for uranium in Western nations (and the earning potential) continuing to increase. It’s underscoring that with the massive Rook I uranium mining project.

“The Project is poised to become one of the largest and most environmentally sustainable uranium operations globally,” Curyer said.

- NexGen isn’t stopping with the US market. The company is also in conversations with European and Asian utilities.

- The Rook I project likely contains an additional 231.7M lbs of U3O8, so there’s room to grow.

+ Market check: $NXE was trading at $8.37 as of close of business Friday, down slightly from its $8.45 open on Wednesday, when the news was announced. Uranium spot prices are sitting at $80.50, which is in line with increases over the last few years but down from the $100+ highs of early 2024.

Lead Reporter of Ignition