The US is one step closer to a domestic supply chain for high-assay low-enriched uranium (HALEU). Five months after a ban on Russian uranium imports freed up $2.7B in federal funding, the DOE has picked four companies to handle domestic production.

Drumroll please…the winners are:

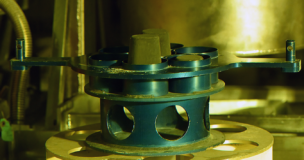

- Urenco, which currently supplies about a third of US LEU, through its Louisiana Energy Services subsidiary

- Orano Federal Services, which recently announced plans to open an enrichment facility in Oak Ridge

- Centrus Energy, which has provided the DOE with HALEU before, through its American Centrifuge Operating subsidiary

- General Matter, which doesn’t have any outstanding enrichment operations and has been hush-hush on details

Each company will receive a minimum of $2M funded by the Inflation Reduction Act in contracts lasting up to 10 years. Pending future appropriations, the US can spend up to the full $2.7B on procuring HALEU from these firms.

The backstory: When Russia invaded Ukraine in 2022, the US and its allies quickly moved to impose sanctions and limit financial interdependence, but Russia’s position as a leading uranium supplier and the strategic importance of nuclear fuel supply kept it off the sanctions list for two years. In May 2024, however, the US officially banned Russian imports.

- Congress had set aside $2.7B in 2024 federal funding for domestic HALEU production, contingent on the ban.

- The ban has now come into force, although US companies can import increasingly smaller amounts of Russian uranium until 2028, when a full ban sets in.

- That deadline motivates the US government and domestic uranium producers to ramp up domestic production—fast.

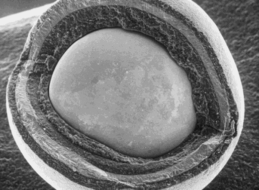

Get advanced: HALEU, as the name suggests, is enriched at a higher level—between 5% and 20% uranium-235—than the low-enriched uranium (LEU) used in most of today’s reactors. It’s an important fuel for the advanced reactors currently under development, and industry and government alike are eager to ensure there’s fuel available when these reactors are ready for primetime.

“All across the country, we are seeing a muscular resurgence in American energy innovation—from bringing back previously shuttered nuclear plants to bringing online new technologies and new reactors to building out the critical fuel supply chain.” White House national climate advisor Ali Zaidi said in a release.

Lead Reporter of Ignition