Authored by Montana Ware

Forming and financing the next nuclear venture comes with a unique set of challenges, particularly in navigating the complexities of a heavily regulated industry while managing the usual questions all startups face. As nuclear startups seek to scale, they often do so by pursuing outside capital from angel investors, venture capital funds and strategic investors – a world that may be new to company founders in the energy space.

Like venture-backed companies in other industries, nuclear startups are generally focused on raising capital without giving away too many rights or too much ownership. At a very early stage, companies will want to avoid complex and costly financing structures. By raising intelligent capital from the beginning, whether in a pre-seed round or the first institutional fundraise, founders can seek to set a precedent for future rounds of investment and retain maximum control and optimal flexibility. That begins with an understanding of the appropriate financing structures based on the stage of the company.

Terms like “pre-seed,” “seed” and “Series A” are used very often to designate the stage of a company and related capital needs. While these terms generally do not have legal significance, they do mean something in the market. Here’s a guide:

Pre-Seed Financing

When a company is raising a “pre-seed” financing round, it usually means one or some combination of the following:

- The company is very early stage and likely bootstrapped to date.

- Target investors largely include individuals, such as angel investors, or even “friends and family,” although some venture funds also participate in pre-seed rounds. (Note: To comply with securities laws, companies typically only raise money from “Accredited Investors,” as defined in Regulation D under the Securities Act of 1933.)

- The company plans to raise money using a convertible instrument like a SAFE or convertible note (which we discuss below).

- The company is testing the waters on investor appetite and valuation, and therefore wants to avoid raising too much money on potentially punitive terms.

SAFEs and Notes

Raising money on convertible instruments like Simple Agreements for Future Equity (SAFEs) and convertible notes is very common at early stages. Convertible securities are issued to investors in lieu of shares of stock but they convert into stock upon the occurrence of a future event – typically, an equity financing in which the company issues preferred stock (also known as a “priced round”) – at a specified valuation cap or at a discount to the valuation in a future priced round.

The primary advantage of SAFEs and convertible notes is that they are simple and easy to issue with limited negotiation and legal cost compared to a priced round. Companies can also avoid setting a current valuation of the company if the SAFEs or convertible notes are not subject to a valuation cap.

SAFEs are a relatively new legal instrument, but they have become a standard for pre-seed funding rounds. The primary difference between SAFEs and convertible notes is that notes are a form of debt subject to interest rates and maturity, while SAFEs are designed to be treated much more like preferred equity.

Priced Financing Rounds

“Series A” and other staged rounds are typically priced rounds, meaning the company raises money by issuing preferred stock at a fixed valuation. The exception is a company’s “Series Seed” round, which typically means a priced round (but occasionally refers to a SAFE or note financing). As noted above, the round nomenclature is not driven by legal considerations, but instead gives potential investors an idea of the stage of the business. For instance, a seed stage company may be working toward a minimum viable product (MVP), while a Series A company may be pursuing product-market fit with its MVP.

Companies typically issue “preferred stock” to investors in a priced round pursuant to a stock purchase agreement. Preferred stock can be structured in a variety of ways, but most preferred stock has the benefit of some or all of the following rights:

- A liquidation preference entitling the investors to a return (or some multiple) of their investment in priority to the common stock. This is typically structured as 1x non-participating preferred stock, which provides investors with downside protection.

- Price-based antidilution protection, allowing the preferred stock to increase its ownership in the event of future stock issuances at a lower price.

- Class-based approval rights over certain major company actions, such as a sale of the company and debt and equity financing.

- The right to elect one or more directors to the board.

The rights of the preferred stock are contained in the company’s certificate of incorporation and certain stockholder agreements:

- An Investors’ Rights Agreement providing the investors with registration rights, information rights, preemptive rights (also known as pro rata rights) which are typically limited to certain “major investors”, and other investor-friendly covenants.

- A Voting Agreement requiring all investors and large common stockholders to vote in favor of a negotiated board structure, and giving certain parties (typically the board, investors and founders voting together) the right to trigger a “drag along” vote in favor of a future sale of the company.

- A Right of First Refusal and Co-Sale Agreement giving the company a primary right of first refusal (ROFR) and the investors a secondary ROFR over founder stock transfers, and also granting the investors a right to “co-sell” shares along with the founders if the ROFRs are not fully exercised.

Today, most priced round financing documents are based on the templates found on the National Venture Capital Association’s website (nvca.org). The financing documents will be negotiated to closely follow a term sheet signed by the company and the lead investor(s). It is therefore very important for companies to be judicious on what is agreed to in the term sheet and to have the benefit of legal counsel prior to signing a term sheet.

Other Considerations for Nuclear Companies

Investors will typically conduct legal due diligence before participating in a financing. Nuclear companies can expect to see heightened focus on regulatory matters during due diligence. Sophisticated investors will expect companies in highly regulated industries (like nuclear) to engage with regulatory counsel and formulate a compliance plan very early on.

Given the importance of achieving certain milestones, funding for nuclear companies (especially in larger rounds) may be structured accordingly. For instance, some rounds may be tiered by unlocking targeted amounts based on the company’s achievement of certain milestones. Investors may also condition equity funding on the company’s ability to obtain nondilutive capital, such as bank loans or DOE grants.

* * *

The nuclear renaissance is being acknowledged in the world of venture capital as investors look to fund profound energy innovations. Investors also understand that, unlike other industries, commercializing a nuclear product takes years of capital-intensive R&D.

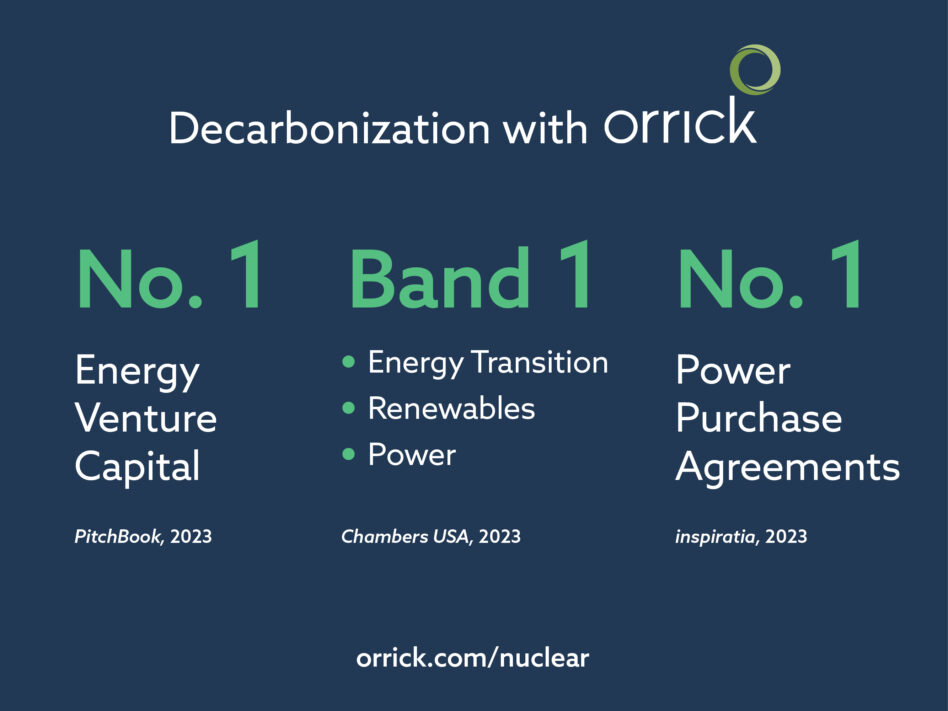

From incorporation basics to funding a next generation power plant, Orrick spans a wide variety of practice areas to address our clients’ needs today while anticipating their needs tomorrow. For more information, insights and resources, please visit the Orrick Tech Studio at orrick.com/tech-studio.