Curtiss-Wright Corp., a provider of high-tech parts and services for aerospace and defense, commercial power, and industrial markets, announced plans on Monday to acquire Ultra Energy for $200M in cash.

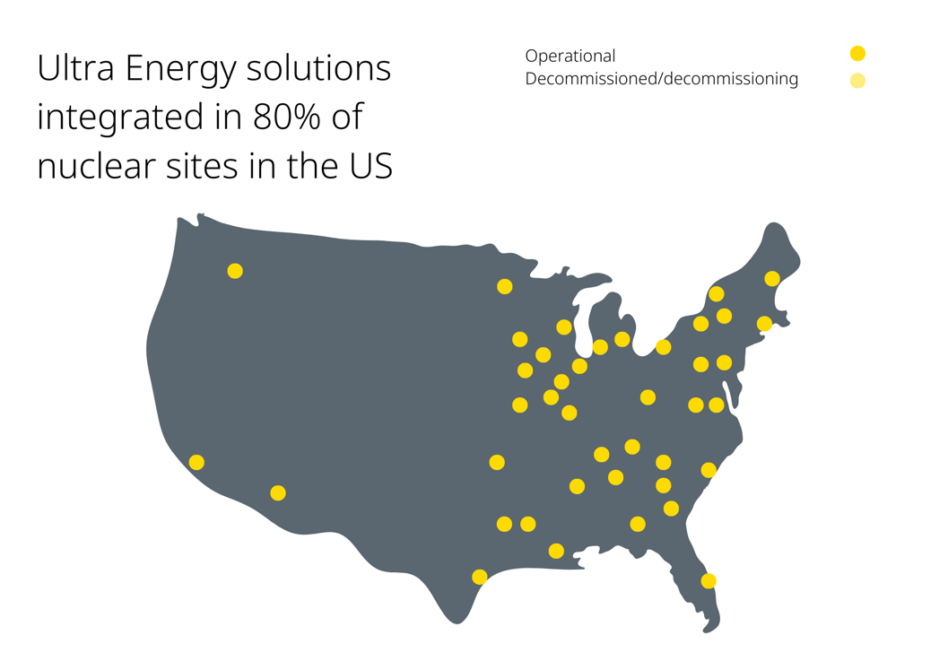

Ultra Energy, a subsidiary of UK-based Ultra Electronics, specializes in designing and manufacturing safety systems and sensors for nuclear power plants. The company posted sales of ~$65M in 2023.

The long game: Strategic acquisitions are a key piece of Curtiss-Wright’s overarching strategy to drive strong financial performance through M&A’s contributions to long-term profitable growth.

Curtiss-Wright CEO Lynn Bamford noted in a statement that acquiring Ultra Energy significantly broadens the company’s global portfolio, supporting existing commercial nuclear power plants and the design of new ones, including SMRs in the US and Europe.

“The transaction provides an opportunity to leverage Ultra Energy’s relationships and UK-based nuclear manufacturing footprint to further expand Curtiss-Wright’s presence with leading global designers of advanced nuclear reactors,” Bamford said.

Right off the bat: Adding Ultra Energy to its roster could make an immediate impact for Curtiss-Wright.

- The acquisition is expected to boost Curtiss-Wright’s adjusted diluted earnings per share in the first full year of ownership, excluding initial purchase costs, and produce substantial cash flow.

- The deal is slated to close in Q3 2024, pending regulatory approval in the UK, with Ultra Energy integrating with Curtiss-Wright’s Naval & Power segment.

Market check: Ultra Energy’s financials are in line with Curtiss-Wright’s recent acquisitions, which have been at or below 12x EBITDA, VP of Investor Relations Jim Ryan told Ignition via email.

Ryan said that the company will have more to share during its August earnings call.