The results are in: The spot price of uranium at the end of 2024 rang in at $72.63 per pound.

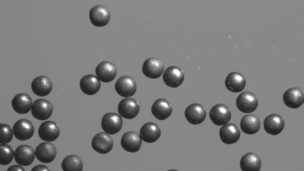

If you’ve been tracking the uranium market’s highs and lows over the last year or so, that seems like a significant drop. At the beginning of 2024, short-term prices were coming in at more than $100—the highest price since 2007—sparking a renewed interest in homegrown uranium extraction businesses.

The current price of uranium has dropped from that soaring high but still reflects a gradual increase since 2020.

Adding intrigue: Geopolitics has complicated the US supply of uranium over the past year. In May, Congress passed a ban on imports of Russian uranium, which accounted for 12% of US uranium ore and 24% of enriched uranium imports as of 2022. Russia responded in kind with its own ban on exporting uranium to the US.

- There are a few years in the interim period where waivers will be granted and exceptions made, but come 2027, a full ban will set in, and the fleet of American reactors will have to look to other sources to make up the deficit.

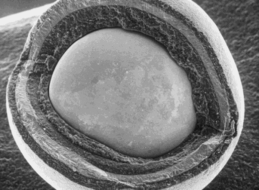

To boost US uranium production, Congress freed up funding to support LEU and HALEU pipeline projects from US companies and friendly faces.

- In October, the DOE picked four companies—Urenco, Orano, Centrus Energy, and General Matter—to provide high-assay low-enriched uranium (HALEU) fuel via a $2.7B contract opportunity.

- In December, the department chose six companies—the same four as the HALEU batch, plus Global Laser Enrichment and Laser Isotope Separation Technologies—to compete to provide low-enriched uranium (LEU) under a $3.4B pool of funding.

Lead Reporter of Ignition