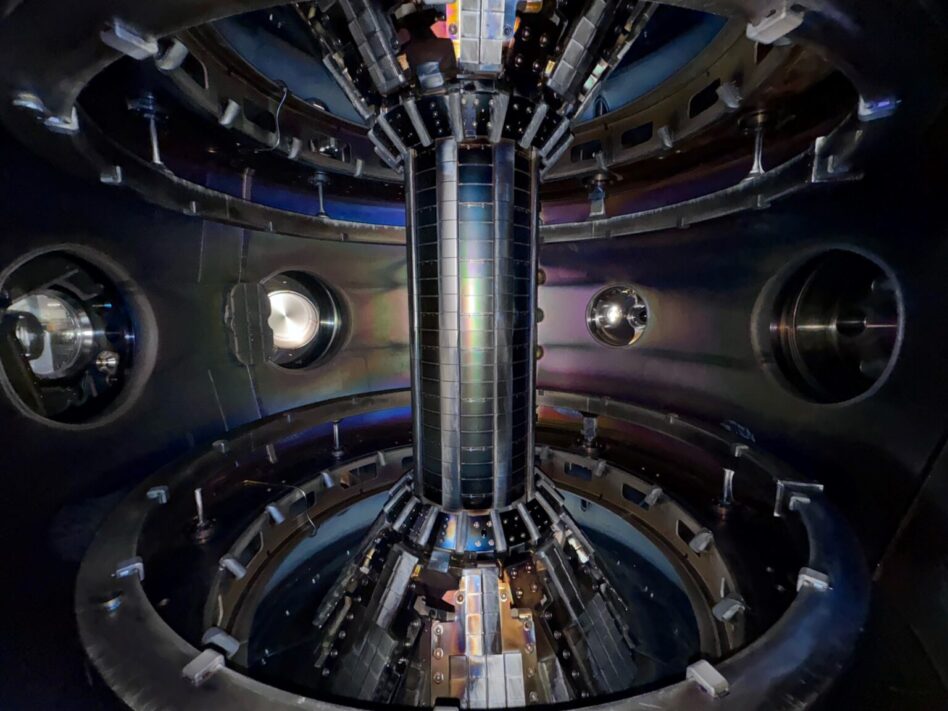

Tokamak Energy, a UK- and US-based fusion startup working on building—you guessed it—a tokamak, has raised a new batch of funding to support the development of high-temperature superconducting magnets for fusion sector customers.

The $125M round was led by East X Ventures and Lingotto Investment Management.

- It also included participation from Furukawa Electric Company, British Patient Capital, BW Group, and Sabanci Climate Ventures.

- Tokamak Energy has now raised $275M to date from private investors and secured an additional $60M through government grants.

“We are focused on commercializing our transformative HTS technology as TE Magnetics,” CEO Warrick Matthews said in a release. “Launching this new business division allows us to focus on our core mission of delivering clean, secure and affordable fusion energy, while supporting our strategy for rapid growth across complementary markets.”

Selling something: Though the company’s ultimate goal is to build a commercial fusion machine, leadership is also looking to generate near-term revenue by developing and selling components while it pursues commercial fusion.

“We want to make ourselves a more robust company by being sustainable and generating revenue so that we can cover ourselves, and then we don’t have to keep coming back to the market to ask for it,” Tokamak Energy US President Michael Ginsberg told Ignition in April.

TE Magnetics, the arm of the company leading superconducting magnet development, is looking to become a key supplier to other companies in the fusion sector pursuing magnetic confinement. Meanwhile, the US side of the company is pursuing spherical tokamak development through a handful of government programs, including the DOE’s Milestone-Based Fusion Development Program.

+ Want more? Ignition caught up with Ginsberg earlier this year on fusion’s place in the energy mix and the company’s approach to technology development and funding. Read the full Q+A here.

Lead Reporter of Ignition