There’s been another wave of funding into the commercial fusion sector, with Fuse Energy Technologies Corp. raising a fresh $32 million. The startup is pursuing an unconventional path to fusion energy by first building pulsed-power inertial fusion machines and using them to help customers test radiation effects.

Buckley Ventures, Tamarack Global, Bracket Capital, Mantis VC, Abstract Ventures, and a handful of individuals participated in the funding round, which values Fuse at more than $200M.

- Bloomberg first reported the raise.

- The round brings the total amount of funding raised to ~$52M, according to a May report by Not Boring that the company had at that point received ~$20M to date.

Along with this funding, Fuse announced a handful of changes in company leadership—and each of the new roles is for someone who invested in the round:

- Laura Thomas came onboard as chief strategy officer. Thomas, a former Pentagon official, has been involved in Fuse but just made the full-time transition.

- Lisa Gordon Hagerty joined the board of directors. She’s a former National Nuclear Security Administration head and Energy Department undersecretary.

- Doug Greenlaw joined the advisory board.

Founding Fuse: Fuse came onto the scene in Montreal back in 2019, spearheaded by then-19-year-old founder JC Btaiche, who saw a less capital-intensive path to building fusion. Specifically, he saw the opportunity to use radiation itself as a product, slowly increasing the power generated by successive radiation machine designs until it’s time to build a full-scale fusion generator.

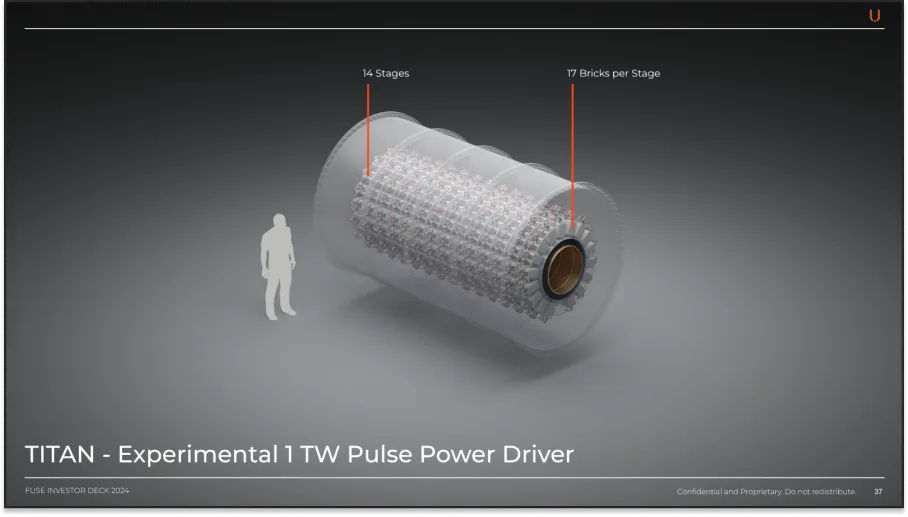

That’s exactly what Fuse has done. It has built several of its TITAN machines, and plans to build many more to sell to customers within and outside government for radiation testing. Fuse also has two more designs planned: a larger test machine called Z-STAR, and a fission-fusion device called Apeiron I.

It’s moved house since its founding and now operates out of a California facility where it plans to manufacture TITANs.

Now what? We’ll give you one guess…that’s right, hiring and scaling. Fuse employs ~30 people right now, and it’s looking to double that headcount over the course of the year.

While the company has a working business with its radiation machines and testing services, actual fusion power generation is still a ways off. Fuse is using the revenue from its current business and government contracts—including a $1.25M Air Force award from last month—to fund fusion machine development.

Lead Reporter of Ignition