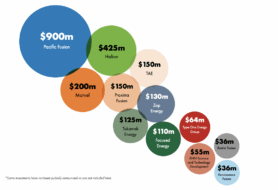

Commercial fusion companies brought in $900M in funding over the last year, per the latest annual report from the Fusion Industry Association (FIA).

Fundraising is down from the year before, but if you zoom in, there’s a changing storyline in the numbers. Public funding for fusion companies rang in at $426M, up 57% year-over-year.

While we’ve got your attention, here are a few of the key numbers:

- 45 total companies are working to commercialize fusion, including 25 in the US alone.

- $7.1B in total funding has been raised for these 45 companies.

- $100M was the largest single fundraise for a fusion company in the last year, going to Xcimer in June, followed by $90M raised by SHINE Technologies.

- One company withdrew from the commercial fusion race.

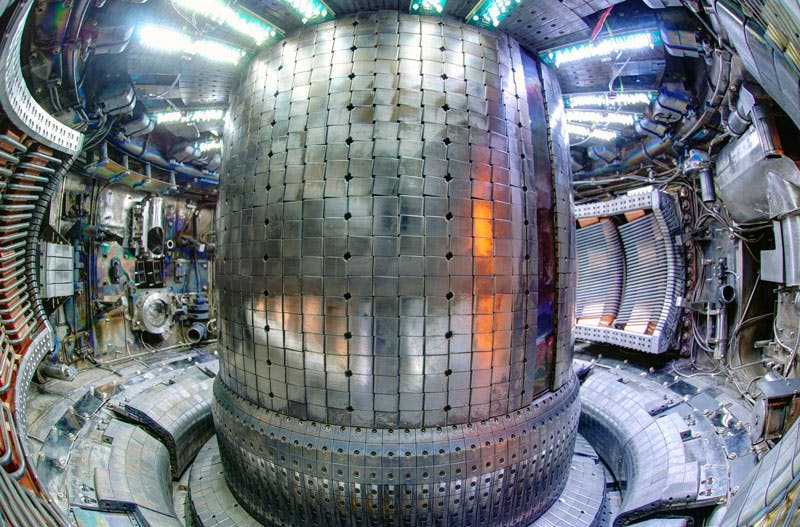

- 23 of the 45 companies are pursuing magnetic confinement fusion, the most common approach, followed by nine companies pursuing inertial confinement.

- Two companies that responded are still in stealth mode (and if that’s you, our inbox is open…just saying 👀).

The public angle: Fusion feels within reach now, particularly with the public sector heavily invested in helping it grow. A number of new programs and policy changes over the last year punctuate that trend, including the DOE’s Milestone-Based Fusion Development Program awards in June and new fusion initiatives in Germany, Japan, and the UK.

“This increase in government investment not only reflects a heightened interest from national governments, but also signals a strategic choice by a growing number of governments that it will be business, not government, that will deliver the pilot plants that demonstrate fusion as a viable energy source,” the report reads.

Building a workforce: The largest growth area reported in this year’s analysis was far and away the workforce. In 2021, FIA reported ~1,100 people working in commercial fusion. This year, it’s more than 4,000.

“Workforce needs will continue to grow, and the industry has adopted an ‘all hands on deck’ approach to hiring skilled employees from diverse backgrounds and outside the traditional scientific sectors,” the report says.

Heads down: The companies surveyed for the report are barreling toward their power goals. Most of them—63%—believe their companies will supply power to the grid between 2030 and 2035, and three companies believe they’ll get it done by 2030.

Lead Reporter of Ignition